maryland digital advertising tax effective date

Digital Advertising Gross Revenues Tax Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived. As a result the legislation automatically became law effective May 12 2021.

Maryland Just Passed The Nation S First Tax On Digital Ads And Big Tech Is Worried

On February 12 2021 the Maryland General Assembly voted to override Governor Larry Hogans veto of House Bill 732 which carried over from the close of last years legislative.

. The tax is imposed on entities with global annual gross. Maryland has now enacted the nations first gross receipts tax targeted on digital advertising. Governor Larry Hogan declined to take action with respect to signing or vetoing Senate Bill 787.

Based on todays veto override the bill should become effective on or about March 14 2021. Under House Bill 932 the 21 st Century Economy Sales Tax ActMarylands sales and use tax was expanded to digital products digital codes and streaming services. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021.

Marylands digital advertising tax is scheduled to take effect March 14 2021. As mandated by the Maryland Constitution the tax will take effect in 30 days. 732 establishes a new digital advertising gross revenue tax the first in any state.

The second bill HB. Of February 12 2021 is later than the effective date of July 1 2020 HB 732 now becomes effective March 14 2021 and appl ies to taxable years beginning after December 31 2020. However because the legislation is applicable to all taxable years beginning after.

The first estimated quarterly payment at least 25 of the reasonably estimated tax based on 2021 Maryland digital ad tax revenues is due to the Comptroller by April 15 th. The Comptroller of Maryland issued its interpretation of the new legislation as. Because the amendment delaying the implementation of the Digital Advertising Services Tax is coming from the Senates president we believe its passage a near certainty.

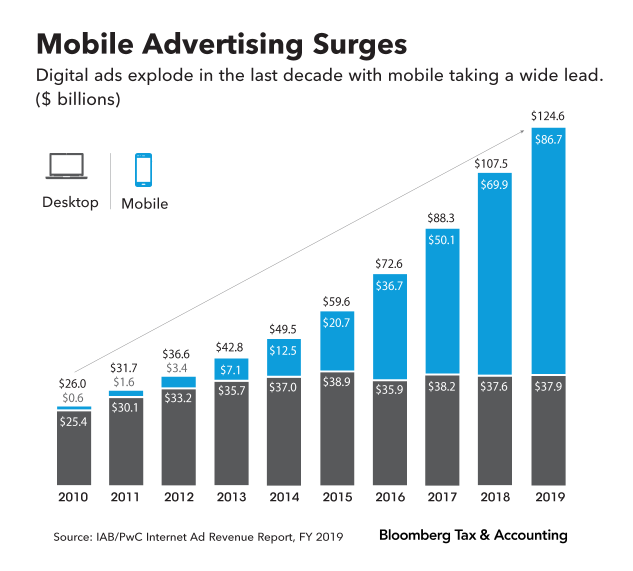

The tax is applicable. The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising. The changes to the taxation of digital products included in SB.

The Digital Advertising Gross Revenue Tax DAGRT was originally passed in March of 2020 but subsequently vetoed by Maryland Governor Larry Hogan. Even though the legislation says the tax is effective July 1 2020 under the Maryland Constitution vetoed legislation becomes effective the later of the effective date in. Maryland Digital Advertising Services TaxImplementation Delay Likely.

787 apply retrospectively to March 14 2021. The effective date subsequently was delayed from 2021 until 2022. The amendment provides exceptions such as disallowing the direct passing of the tax onto the consumer and exempting broadcast and news media entities.

Maryland Delays Digital Advertising Services Tax Bdo

Extension Announced For 2021 Maryland Income Tax Filing Payment

Digital Ad Tax Suit In Maryland Becomes Test Of States Rights

Maryland Narrows Definition Of Taxable Digital Goods For Sales Tax

Battle Against Maryland Digital Advertising Tax Continues As First Payments Come Due

Economic Nexus Laws By State Taxconnex

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

Maryland State Tax Updates Withum

Taxing Internet Ads Could Raise Lots Of Money But Doubts Persist The Pew Charitable Trusts

Digital Goods Now Taxable In Maryland Taxjar

Maryland S Gas Tax Increasing By 7 Cents At Midnight Thursday

Latest Impacts To 2021 Tax Season Filing Dates Wolters Kluwer

Maryland Passed A Tax On Digital Advertising What Happens Next Adexchanger

Maryland Narrows Definition Of Taxable Digital Goods For Sales Tax

Maryland Narrows Definition Of Taxable Digital Goods For Sales Tax

How Do I Get A Copy Of My W 2 Online W 2 Early Access H R Block

Maryland Narrows Definition Of Taxable Digital Goods For Sales Tax