trust capital gains tax rate australia

Capital gains withholding - Impacts on foreign and Australian residents. CGT for specific investment products.

Budget Basics Federal Trust Funds

Capital Gains Tax CGT is a tax you pay on the sale of non-exempt assets in Australia that were acquired after the 20 September 1985.

. Foreign resident capital gains withholding. There is no set rate of CGT in Australia for individuals. Lets assume that Agnes in her will leaves her estate to Adam via a testamentary trust.

Where there is no testamentary trust in place the 18000 will be taxed in Adams hands at his full tax rate. Trust non-assessable payments CGT event E4. Instead you pay CGT at your marginal rate of tax if you need to pay it.

Disposal of a trust asset or another capital gains tax event is likely to result in a capital gain or loss for the trust unless a beneficiary is absolutely entitled to the asset. And for SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. Market valuation for tax purposes.

Using a testamentary trust. Capital gains withholding - a guide for conveyancers. However if the asset is owned by a company the company is not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains.

CGT event is the date you sell or dispose of an asset. Trading companies on the other hand pay a flat rate of CGT 26 if their. What is a CGT event.

Capital gains withholding - for real estate agents. That would mean that he would have a net income of 98535 a total increase of 11207 annually. The capital gain or loss is generally taken into account in the trusts net capital.

How Is A Family Trust Taxed In Australia Liston Newton Advisory

2022 Trust Tax Rates And Exemptions Smartasset

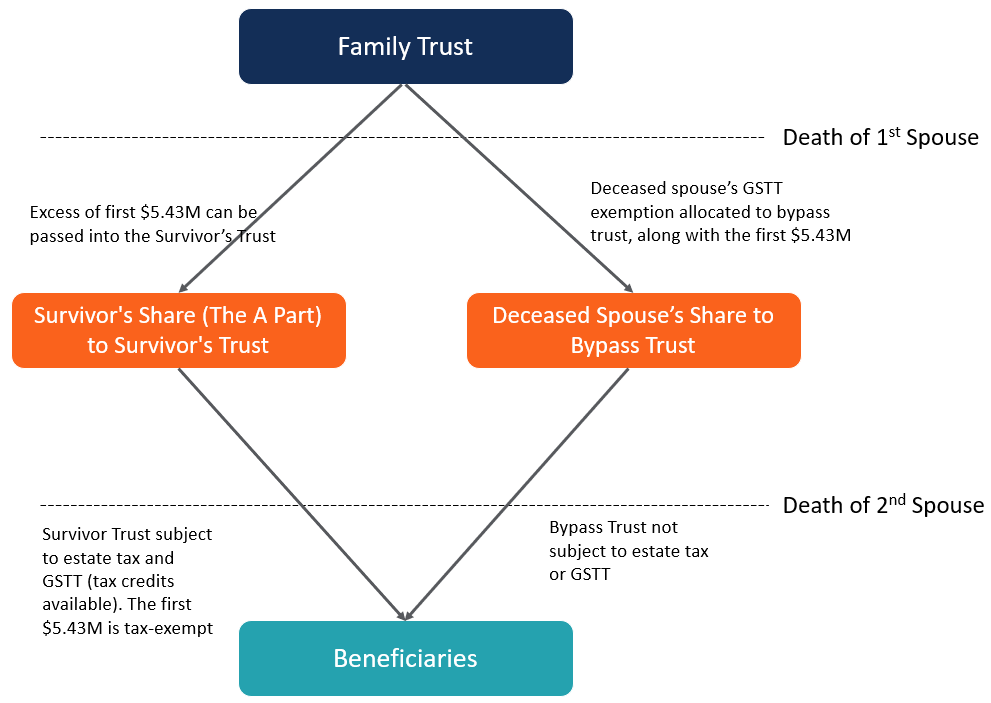

A B Trust Overview Purpose How It Works Advantages

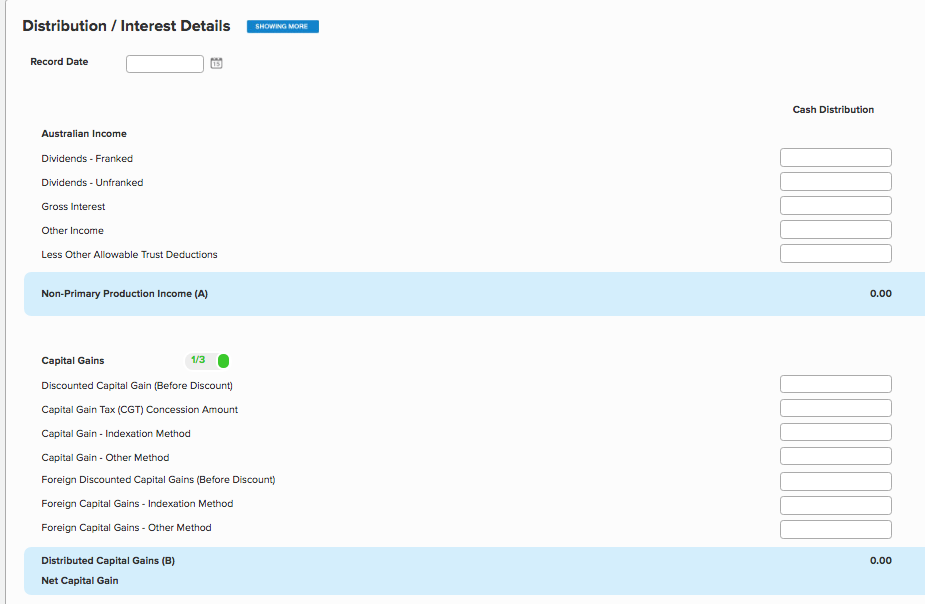

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Health And Social Problems Are Worse In More Unequal Countries The Spirit Level Wilkinson Pickett Penguin 2009 Social Problem Math Literacy Social Class

How To Avoid Estate Taxes With A Trust

2022 Trust Tax Rates And Exemptions Smartasset

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

In Gold We Trust Why Bullion Is Still A Safe Haven In Times Of Crisis Gold Bullion Gold Money Buying Gold

Matthew Ledvina Offers Us Tax Structuring Strategy Tax Return Us Tax Tax

What Are The Tax Advantages Of A Trust Legalvision

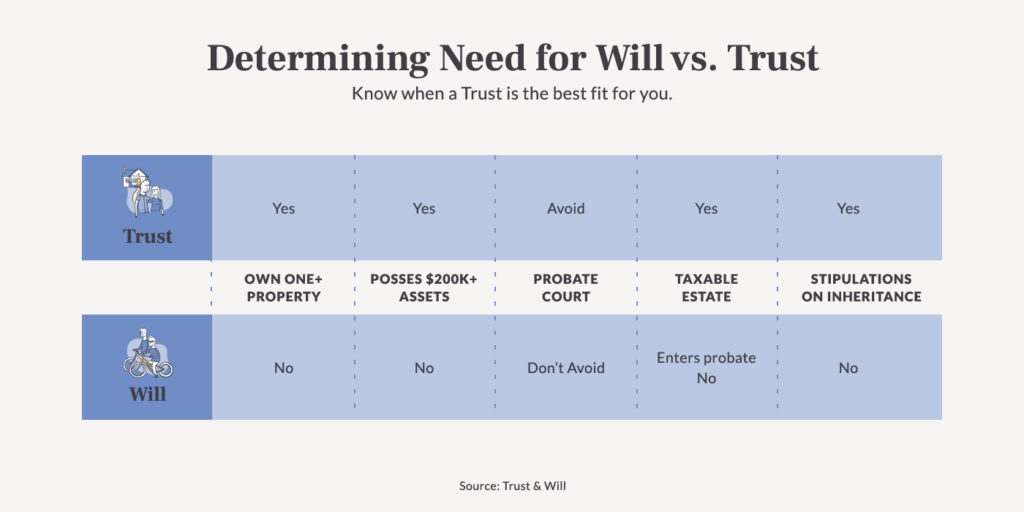

What Is A Trust In Estate Planning Trust Will

What Are The Tax Advantages Of A Trust Legalvision

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

How To Avoid Estate Taxes With A Trust

How To Avoid Estate Taxes With A Trust

Common Types Of Trusts Findlaw

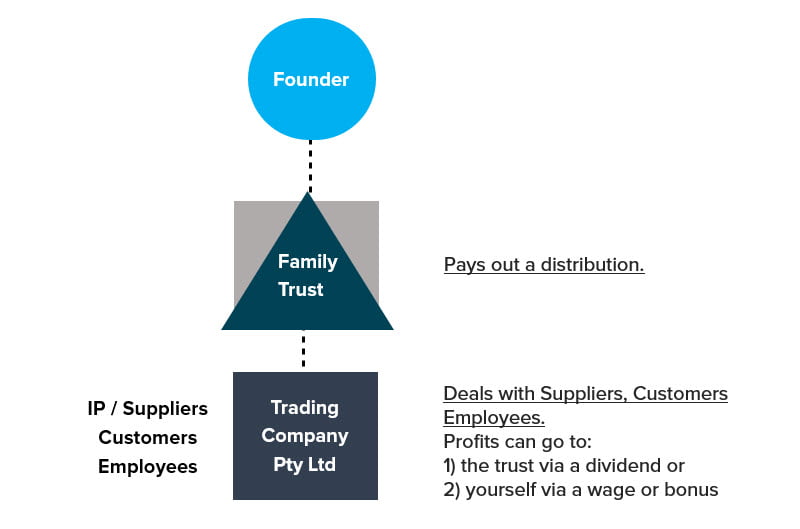

Including A Family Trust In Your Business Structure Fullstack Advisory